38+ 20 year fixed rate mortgage calculator

6125 6483 038. These withdrawals currently 738 at age 71 rising to 20 by age 94 can push your annual income into higher tax brackets and cause reductions in other benefits like OAS.

Music Concert Ticket Psd Template Free Music Concert Concert Tickets Concert Ticket Template

The big advantage of a 30-year home loan over a 20-year loan is a lower monthly payment.

. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. 15 year fixed VA. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older.

Between January 2012 to 2017 the average rate ranged between 334 percent to 453 percent. Second mortgage types Lump sum. The FHA helped develop and standardize the fixed-rate mortgage as an alternative to the balloon payment mortgage by.

Meanwhile ARMs accounted for only 09 of the market while 8 of the market share was comprised of other mortgage products such as 20-year and 10-year fixed-rate loans. It increased to 509 percent in 2010 but went down to 477 percent in 2011. Meanwhile the Urban Institute reported that 30-year FRMs made up 742 of new loan originations in 2020 while 09 accounted for ARMs.

238 306 Sep 12 2022 91222. For today Thursday September 15 2022 the current average rate for a 30-year fixed mortgage is 619 increasing 11 basis points compared to this time. The Urban Institute describes 15-year FRMs primarily as refinancing products.

Disadvantages of 30-year fixed-rate mortgage. The average interest rate for the most popular 30-year fixed mortgage is 548 according to data from SP Global. The average cost of a 15-year fixed-rate mortgage has also increased to 438 as of April 21 jumping 209 year-over-year.

Find average mortgage rates for the 15 year fixed rate mortgage from Mortgage News Daily. Todays national mortgage rate trends. If your mortgage payments are 10000 per year and your marginal tax rate is 20 you have to earn 12000 to pay that mortgage although you may be able to deduct a.

A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. Private mortgage insurance PMI you made a 20 down payment worth 65000. In October 2019 the 15-year FRM market share was.

The loan is secured on the borrowers property through a process. The MND Rate Index is the best way to follow day-to-day movement in mortgage rates. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan.

Mortgage Amount Interest Rate. To illustrate how bi-weekly payments work lets compare it with monthly payments. While balance transfer cards with introductory APRs usually last a full year.

Mortgage interest rates are always changing and there are a lot of factors that. Unlike mortgage rate surveys our index is driven by real-time changes in actual lender rate sheets. Simple Mortgage Calculator.

The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. In this example if you apply for a mortgage with your spouse your front-end DTI ratio will be 2053 and your back-end DTI ratio will be 3417. A Monthly Chartbook released in June 2020.

Conventional 20 year fixed. Just as this article describes a bond as a 30-year bond with 6 coupon rate this article describes a pass-through MBS as a 3 billion pass-through with 6 pass-through rate a 65 WAC and 340-month WAM. 10 Year Fixed Rate Mortgage Calculator.

This rate is applied when. Here are some of the advantages of a 20-year mortgage over. The calculator below also accounts for other homeownership costs such as real estate taxes homeowners.

Fixed-Rate Mortgage ARM 1 ARM 2 ARM 3. What is a 30-year fixed rate mortgage. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2022.

Mortgage refinance calculator. Using our calculator above you can estimate the savings difference conveniently. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

Guaranteed Rates 30-Year Mortgage. This data is based on Housing Finance at a Glance. If your lenders DTI limit is 28 for front-end DTI and 36 for back-end DTI you have a good chance of qualifying for a mortgage.

However for those who can afford the slightly higher payment associated with a 20-year mortgage are getting a better deal in almost every possible way. It is the second most purchased type of mortgage product next to 30-year fixed-rate loans. Second mortgages come in two main forms home equity loans and home equity lines of credit.

If you can comfortably afford the monthly payments on a 15-year fixed-rate mortgage. Advantages of a 20-Year Fixed-Rate Home Loan. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

Name of lender or broker contact information. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term. And the 51 adjustable rate mortgage rose 375 up 92 basis points.

Section 179 deduction dollar limits. As for 30-year fixed-rate mortgages Urban Institute reported that it. In January 2009 the average 30-year fixed mortgage rate dropped by 106 percentage points from 2008.

Find average mortgage rates for the 30 year fha fixed mortgage from Mortgage News Daily and the Mortgage Bankers Associations rate surveys. A 30-year fixed rate mortgage is a home loan structure that establishes an unchanging interest rate throughout the course of the loan. The remaining 8 represented other types of mortgage products such as 10-year and 20-year fixed-rate loans.

Loan term eg 15 years 30 years Loan description eg fixed rate 31 ARM payment-option ARM interest-only ARM Basic Figures for Comparison. And since your DTI is low youre entitled to a more favorable. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property.

Conventional 20 year fixed. The interest rate charged on the outstanding principal balance does not change month to. The Higher Value 4 Year Fixed Interest Rate is available to new and existing AIB mortgage customers including Switchers Top-ups and Self Builds with a mortgage loan of at least 250000 and a term of 4 years or more.

Across the United States 88 of home buyers finance their purchases with a mortgage. Fixed-rate mortgage interest rate and annual.

G64421mmi057 Jpg

20 Budget Templates In Word Free Premium Templates

20 Gardening Ideas Using Rocks And Stones Landscaping With Rocks Rock Garden Landscaping Garden Stepping Stones

5356 Eighth Line Erin On Land Lot For Sale Rew

River Rock Garden Ideen Rock Garden Ideen Fur Kleine Garten Shade Rock Garde Rock Garden Design River Rock Landscaping Diy Landscaping

Pin On Building

Luke 9 Commentary Precept Austin

Free 38 Example Of Statement Forms In Pdf Excel Ms Word

G64421mmi016 Jpg

Free 9 Loan Spreadsheet Samples And Templates In Excel

Basic Speech Outline Template Speech Outline Speech Outline

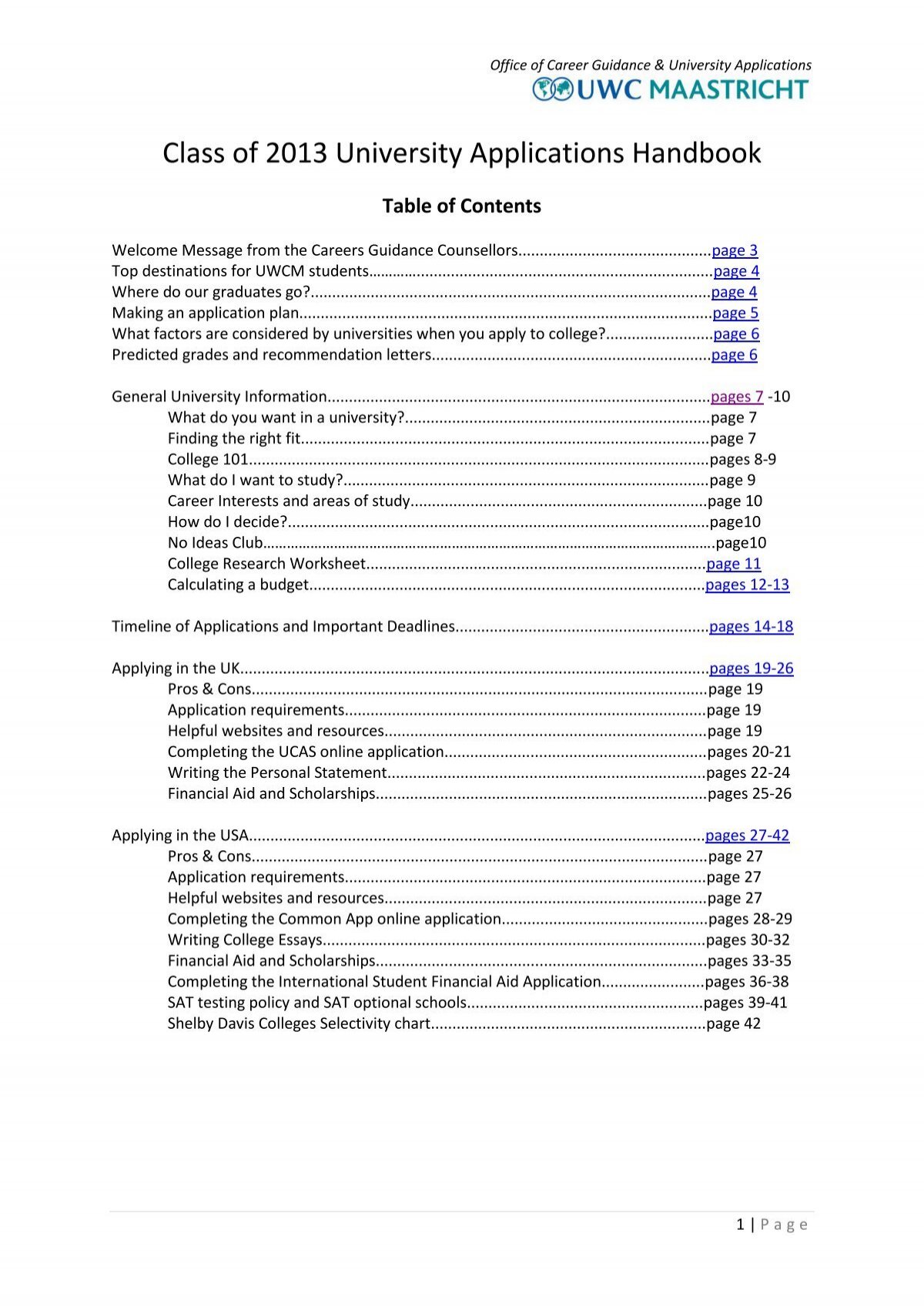

Class Of 2013 University Applications Handbook Uwc Maastricht

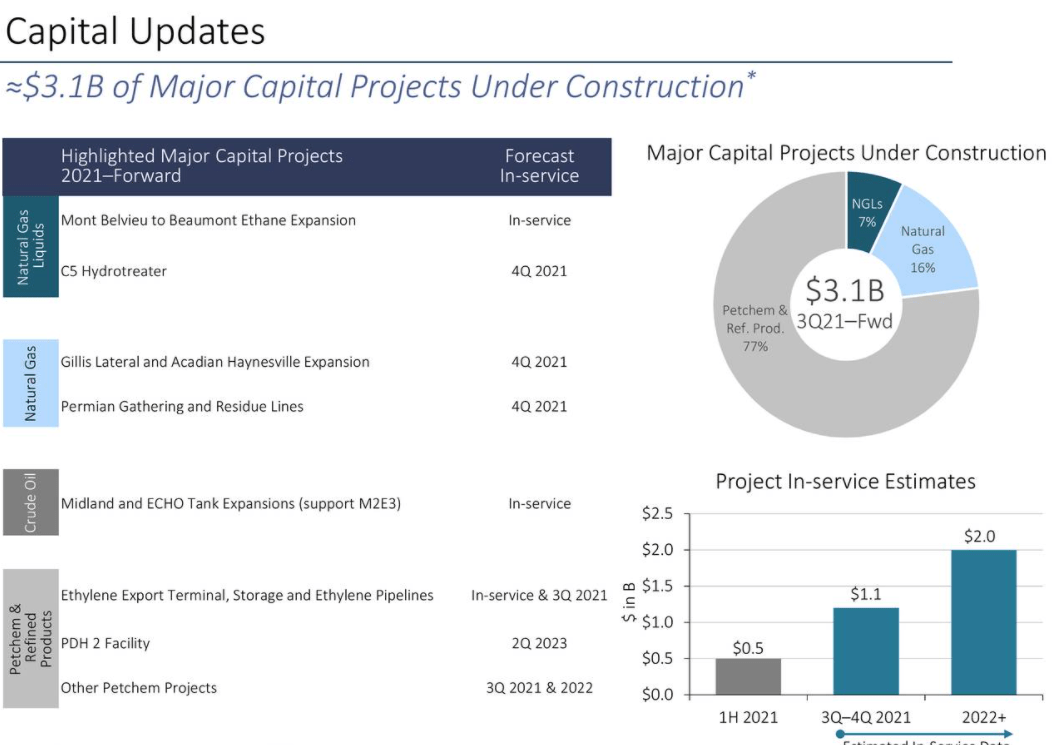

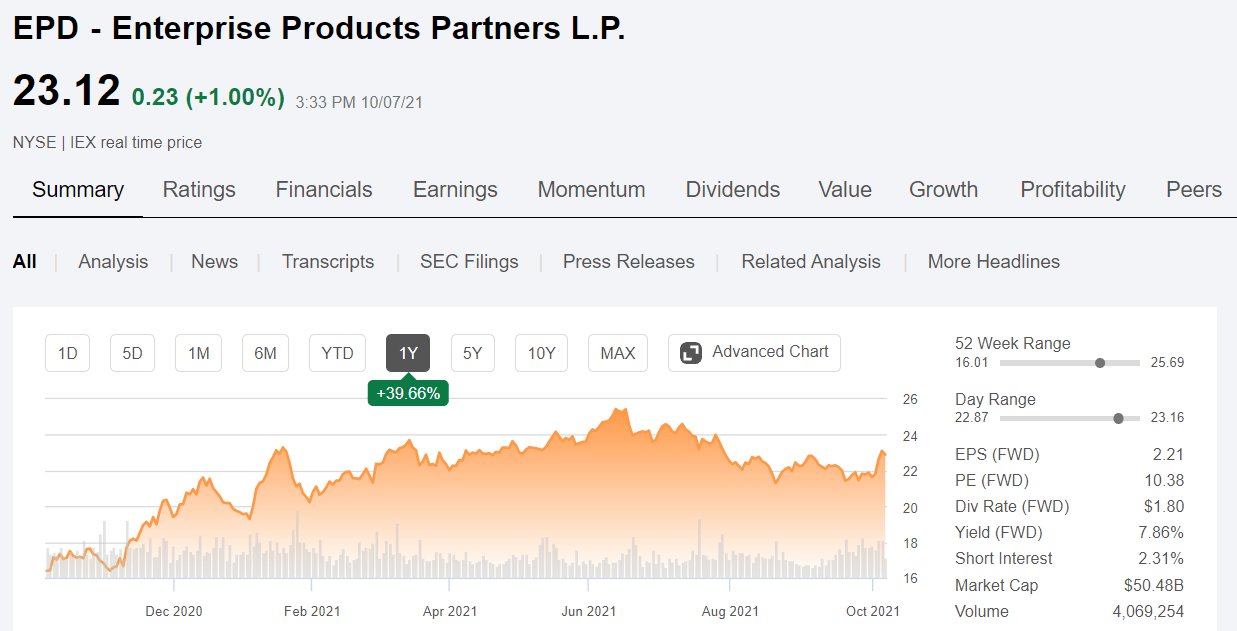

Enterprise Products Partners Stock Compelling Value Nyse Epd Seeking Alpha

Free 38 Sheet Samples Templates In Pdf

Notice Of Eviction Date Letter Templates Eviction Notice Words

15 Birth Certificate Templates Word Pdf Template Lab Birth Certificate Template Fake Birth Certificate Birth Certificate Form

Enterprise Products Partners Stock Compelling Value Nyse Epd Seeking Alpha